Is there really a shortage of workers or workers who want to work …

Granted, the above headline is a bit redundant, but this month’s analysis could be a different take on this subject that has not been widely reported. And this part of the labor force is a meaningful portion of the temporary help workforce, so this discussion could have important implications to the staffing sector.

Labor force, a.k.a. workforce, data are normally reported as seasonally adjusted numbers that take into account the — well — seasonally ups and downs. But, not seasonally adjusted data are raw numbers and may reveal more real ground level trends. Although the trendlines rarely run differently between the seasonally and not seasonally adjust data, the actual numbers differ. Not seasonally adjusted data are examined for this discussion.

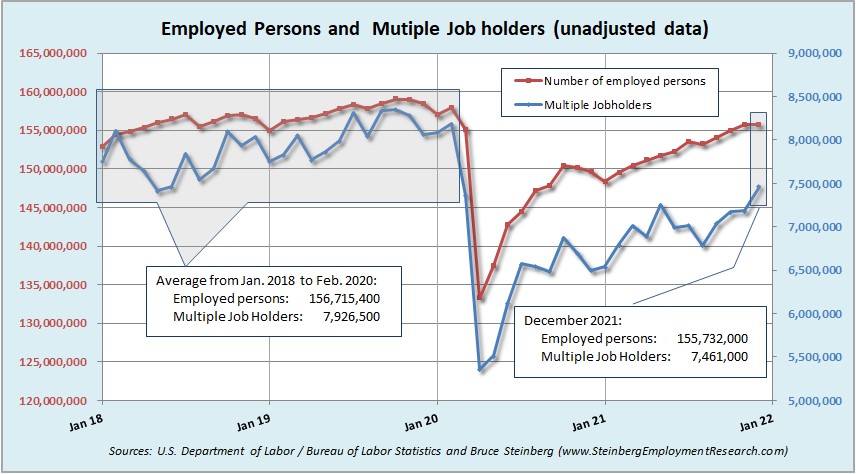

Although multiple job holders are not necessarily a very large part of the total number of employed persons, they are not an insignificant portion at around 5 percent — and that ratio is less now than prior to the pandemic, which brings us to the discussion at hand.

From January 201 to February 2020, before the pandemic started to affect employment, multiple jobs holders were 5.1 percent of the total number of employed persons. In April 2020, the first full month the pandemic affected employment data, that ratio dropped to 4.0 percent and slowly began to rise to 4.8 percent by December 2021. (Because this analysis is prepared prior to the release of the current employment situation, it lags by a month.)

In raw numbers, the number of employed persons was only 983,400 less in December 2021 than the average of the 26-month period prior to the pandemic. For multiple job holders, there were 465,500 fewer in December 2021 than prior to the pandemic.

Perhaps one of several reasons there are fewer multiple job holders and hence people available for temporary help job openings could be because of wage increases at the lower end may be outpacing inflation, at least for the time being. Maybe those at the lower end of the wage scale do not find it necessary or have sufficient incentive to work multiple jobs. There is no single right answer or over encompassing reason covering all situations.

January 2022 Employment Report

Quick recap

Almost all of the so-called experts were predicting — a.k.a. “consensus estimates” — job losses in January. But what they did not realize that they can look like idiots trying to predict the numbers. Perhaps they did not not think the annual revisions / benchmarking to the data can change recent trends in the numbers. We realize that many of our readers will try and dismiss the official data, but they are what they are.

We suspect a lot of private-sector economists will either be dismissing the official U.S. Bureau of Labor Statistics data and / or adjusting their algorithms / models. Or maybe even updating their resumes.

One of the reasons for the apparent disconnect is that the job numbers from May through July were much worse than previously reported, which had the effect of H2 2021 being revised as much better than earlier reported.

The unemployment rate was essentially unchanged at 4.0 percent in January and although that was a lower number than in December, because of the aforementioned annual revision process, is not necessarily comparable to previous data. For more detail, jump to the Household Survey section at the bottom of this column.

However, despite the consensus estimates predicting a big drop in the jobs number, the overall nonfarm job growth was up and by significant amount. In January, total nonfarm jobs increased 467,000. And past months performances were revised much higher as well. The annual revisions / benchmarking of these numbers now say that all jobs were up 510,000 in December, up 647,000 in November and a year ago in January 2021, up 520,000.

Average hourly wages were up 23 cents in January from December, which was a 5.7 percent increase over the past 12 months.

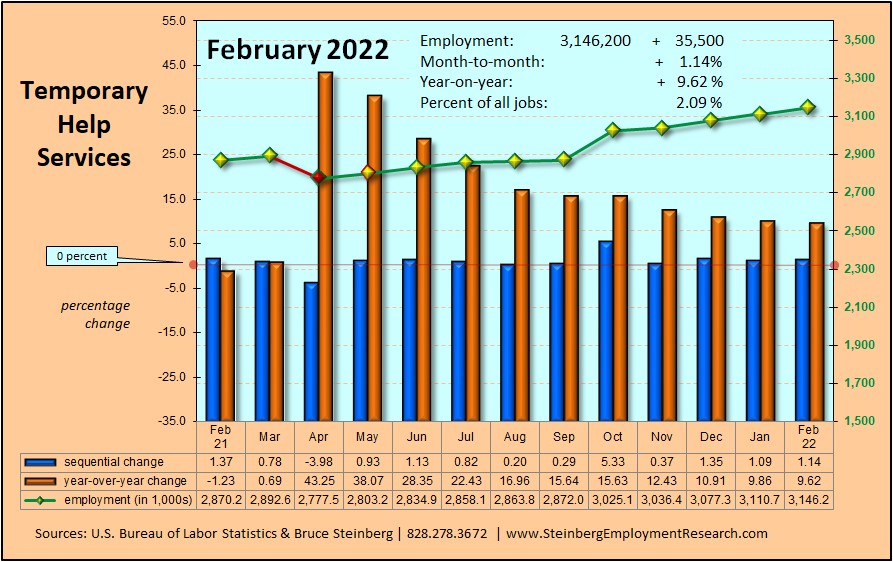

Although contrary to what we hear from some staffing professionals, Temporary Help Services not only increased, but had been reaching new highs in the past few months.

Jobs Report

Private sector employers added 444,000 in January after adding 503,000 in December; a year ago the private sector added 423,000 in January 2021.

The private Goods-producing sector added only 4,000 jobs in January after gaining 62,000 in December.

- Manufacturing growth gained 13,000 jobs in January after adding 32,000 in December.

- The Construction sector was down 5,000 in January after adding 26,000 in December. Maybe managers came to the realization that a lot of the workers they found for jobs in December were best left unfound and eliminated those jobs in January.

- Mining and logging was down 4,000 in January after adding that same amount in December.

The private Service-providing sector was consistent with a gain of 440,000 jobs in January after adding 441,000 in December.

- Activity picked up in the Retail trade sector that added 61,400 jobs in January after increasing by 40,100 in December.

- Wholesale trade sector slipped a little but probably did not result in any big workers’ comp claims with an increase of 16,400 in January after adding 20,400 in December.

- On the other hand, Transportation and warehousing continued to add jobs at a much faster pace with an increase of 54,200 in January and that was more than double the 25,300 gain in December.

- Financial activities slowed with a gain of 9,000 in January after adding 17,000 in December.

- The Professional and business services sector was steady with an increase of 86,000 in January after adding a similar amount of 88,000 in December. Computer systems design and related services computed in 14,800 more jobs in January after adding 12,800 in December. Management and technical consulting services added 15,700 in January that followed an increase of 9,000 n December. Architectural and engineering services gained 8,400 jobs in January, which followed a 10,400 increase in December.

- The entire private Education and health services sector was up 29,000 in January. Home health care services was down 1,700 in January after adding almost the same amount of 1,800 in December.

- The entire Leisure and hospitality sector was up 151,000 in January after adding 163,000 in December.

The total number of Government jobs was up 23,000 in January. The Federal government was down 2,000 in December and state government was also down by 9,000 while local government increased a total of 33,000 jobs with with the lion’s share of that increase in education.

Temporary Help Services Roundup

The government’s annual revisions / benchmarking process really played havoc with Temporary Help Services. The new data show that THS reached new highs starting at the end of 2021. In January, THS added 26,300 jobs and that works out to a sequential increase of 0.9 percent and a year-on-year gain of 9.2 percent. This translates into 3,091,200 THS jobs in January 2022.

For a chart of THS jobs compared to all nonfarm jobs, click here.

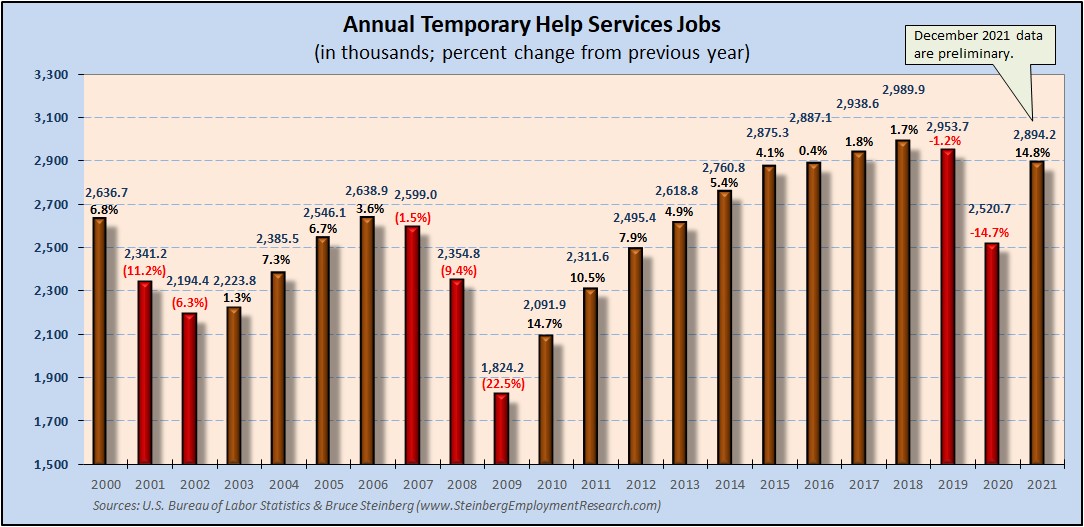

Although the December datum point is only considered preliminary and subject to revision next month, the BLS’s annual benchmarking process that was published this month shows that THS increased 14.8 percent in 2021 compared to a 14.7 decrease in 2020. Pretty even-Steven, but we suspect a lot of staffing company owners do not feel that way.

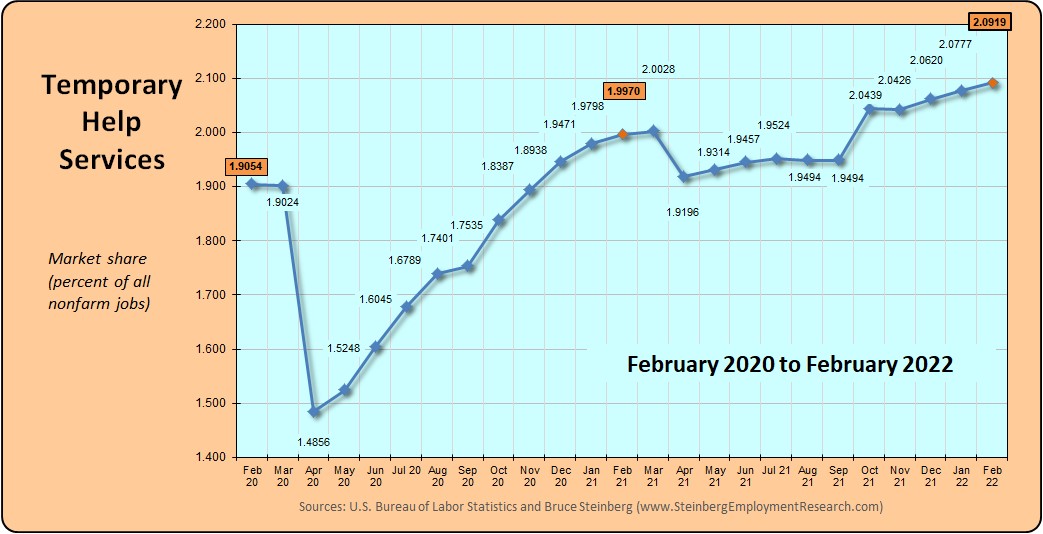

In January, temporary help services market share, or its portion of all jobs, was 2.0659 percent and this is an all-time high. It was 2.0547 the previous month and a year ago in January 2021, it was 1.9798 percent and two years ago in January 2020 it was 1.9284 percent. Dismissing October through December 2021 figures as this metric rose, THS’s previous zenith was in April 2018 when it was 2.0172 percent.

Household Survey

The unemployment rate remained low ate 4.0 percent in January 2022.

Because of updated population estimates, January’s data from the household survey is not directly comparable with December’s numbers.

Regardless, we will assume that the labor force expanded as did the number of employed persons, but so did the number of unemployed persons and by a greater amount. The workforce participation rate as well as the employment-population ration also increased in January 2022.

Did you know that we maintain an updated table of many major employment as well as other general economic indicators here or here for the mobile version?