Labor Forecast Predicts 19.1% Increase in Demand for Temporary Workers for 2021 Third Quarter, Signaling Further Signs of Recovery Ahead

— Industry Consulting Firm G. Palmer & Associates’ Quarterly Forecast Assists in Previewing Near-Term Hiring Patterns —

Newport Beach, California, July 15, 2021, — Demand for temporary workers in the United States is expected to increase 19.1% on a seasonally adjusted basis for the 2021 third quarter, when compared with the same period in 2020, according to the Palmer Forecast™, released today. The increase in demand principally reflects economic recovery from the pandemic-related business lockdowns of a year ago and the US economy getting back to a more normal pace.

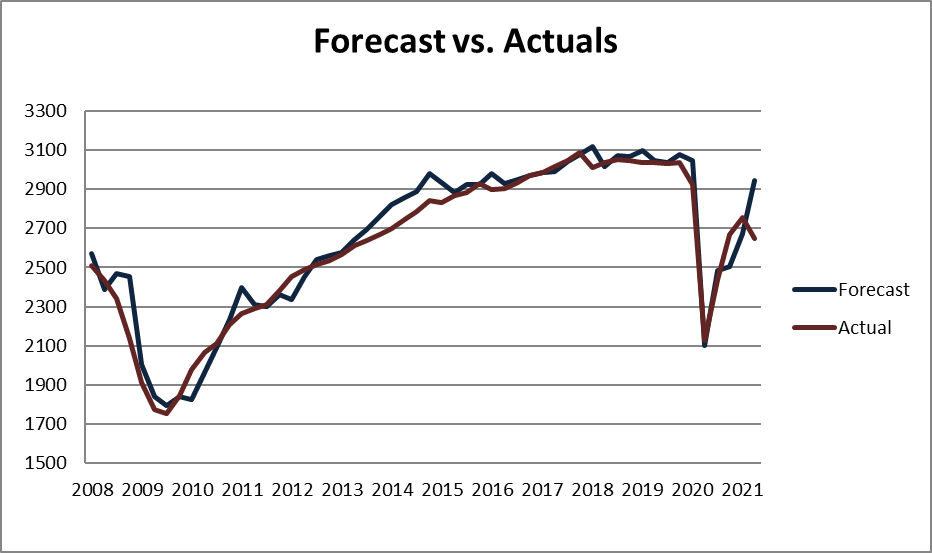

The Palmer Forecast™ indicated a 45% increase in temporary help for the 2021 second quarter. Actual results as reported by the Bureau of Labor Statistics (BLS) came in less than anticipated, with an increase of 30%. The difference was due primarily to higher than anticipated unemployment rates. The federal government’s enhanced weekly unemployment benefits enacted early in 2021 also may be a contributing factor, although demand for labor is strong, as reported by the BLS, with 9.2 million open jobs at the end of June.

Source: G. Palmer & Associates; Bureau of Labor Statistics (BLS)

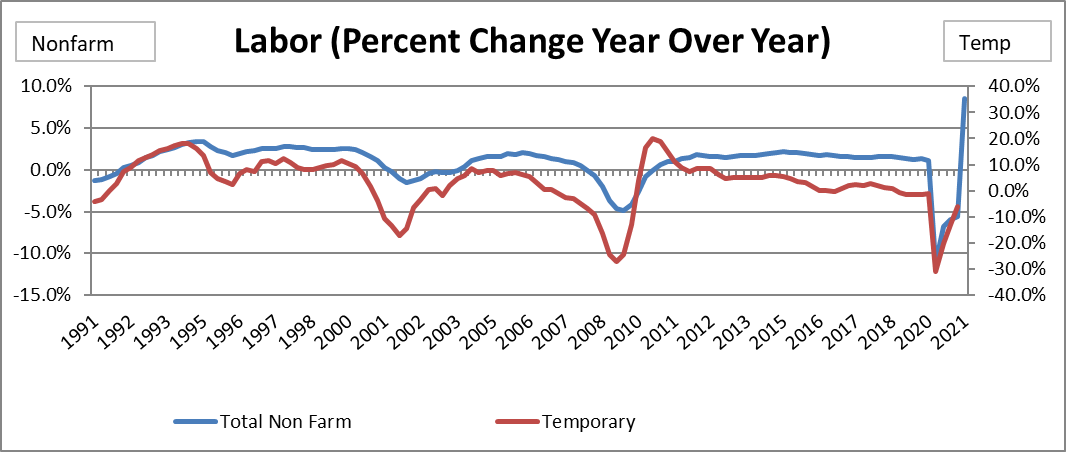

Source: Bureau of Labor Statistics (BLS)

There has been a solid rebound in temp help jobs thus far in 2021, with 33,000 temp help jobs added in June, or 7,600 on average per month through the first half of the year. According to the BLS, 332,000 temp jobs were lost in 2020, the second straight year of declines, or an average job loss of 27,750 per month. The BLS also reported that 42,000 temp help jobs were lost in 2019, an average of 3,500 fewer jobs per month. In 2018, more than 99,000 temp help jobs were added versus 2017, an average of 8,200 per month. Additionally, 96,000 temp jobs were added in 2017 over 2016, an average of 8,000 per month, compared with 32,000 temp jobs added in 2016, or an average of 2,600 per month. In 2015, approximately 97,000 temporary jobs were added, compared with 162,000 new temp jobs in 2014.

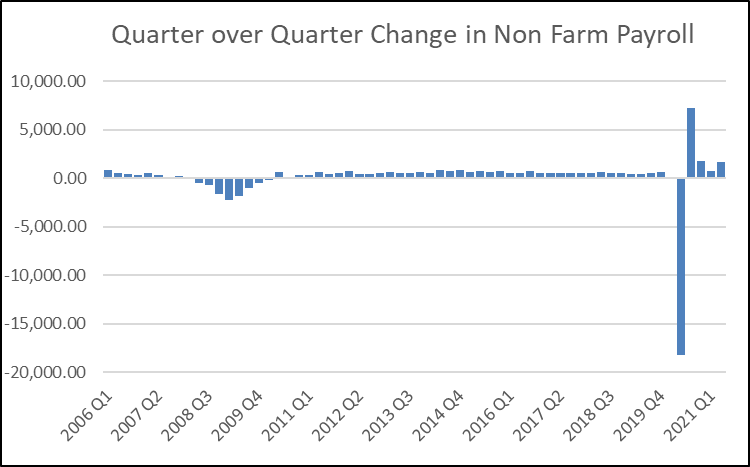

The Labor Department reported nonfarm payroll employment increased by 850,00 jobs in June 2021, significantly better than consensus estimate increases of 700,000 jobs. For the second quarter 2021, non-farm jobs increased to 567,000 on a monthly average basis, up 5.75% year-over-year. For 2020, nonfarm employment was down 6.17%, or 9,372,000 jobs, compared with 2019. To put this in perspective, there were 176,000 jobs added on average per month in 2019 and 2.1 million total jobs added for the year, which was less than the 220,000 added per month in 2018, and 2.6 million for that year. For 2017, a total of 2.1 million new jobs were created, versus 2.2 million new jobs in 2016.

The key categories of jobs created are as follows:

- Total Non-farm jobs: +850,000

- Private Sector: +662,000

- Leisure and Hospitality: +343,000

- Government sector: +188,000

- Construction: +110,000

- Professional and Business Services: +72,000

- Retail: +67,000

- Education and Health Services: +59,000

- Temp Help: +33,000

- Manufacturing: +15,000

Source: Bureau of Labor Statistics (BLS)

In March 2021, the labor participation rate was unchanged at 61.6%, and it has been in a narrow range of 61.4% and 61.7% since June of 2020. The U3, commonly referred to as the unemployment rate, increased slightly to 5.9% in June, from 5.8% in May.

As reported by the BLS, the rate of unemployment for workers with college degrees increased 30 bps in June versus May, to 3.5%, and the unemployment rate for workers with less than a high school education increased 110 bps to 10.2%. The U6 unemployment rate, which tracks those who are unemployed, as well as those who are underemployed and are working part-time for economic reasons, was down 40 bps to 9.8% in June versus May. The U6 rate is considered the rate that most broadly depicts those most affected by the last economic downturn and measures the rate of discouraged workers.

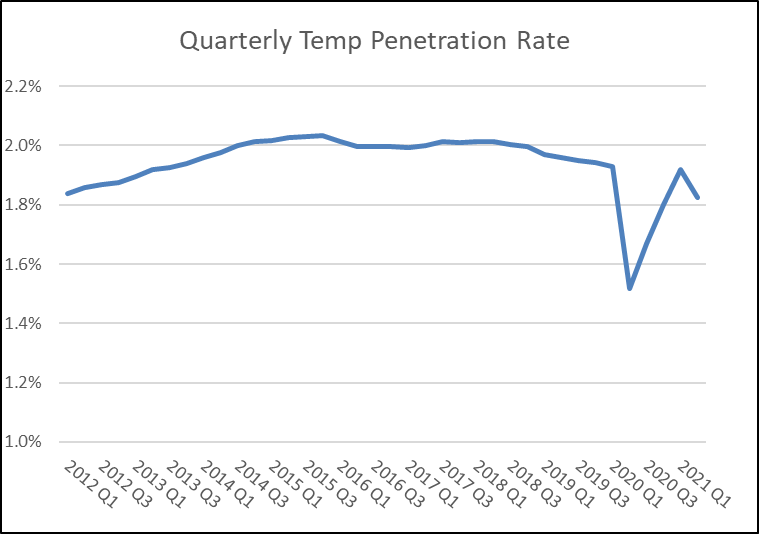

“As welcomed as the increases are, they need to be kept in perspective because of the unusual effect of pandemic and resultant recovery,” said Greg Palmer, founder and managing director of G. Palmer & Associates, an Orange County, California-based human capital advisory firm that specializes in workforce solutions. “One of the most revealing indicators to watch is the temp help penetration rate, because it measures temp help as a percentage of total employment. In June 2021, the temp penetration rate increased 10 bps from May, to 1.83% of the total labor market, versus 1.57% pre-pandemic. The penetration rate cycle peak at 2.05% in December 2019 and a low of 1.3% in June 2009.

Source: Bureau of Labor Statistics (BLS)

“The temp help employment market improved again in June, and the trend most likely will continue as businesses reopen further,” Palmer added. “The largest issue remains the number of workers re-entering the workforce, as they are able to be more selective in seeking new opportunities with high demand for employees. Staffing companies are reporting extreme difficulty in filling the many current open jobs they have. The American Staffing Association Staffing Index is also rebounding from an index low of 59.9 on May 10, 2020, to a strong close of 97 on June 22, 2021, a 44.2% increase from the same week last year. This all adds up to further signs of recovery in temp help as we move further into 2021.”

About the Palmer Forecast™

The Palmer Forecast™ is based, in part, on BLS and other key indicators. The model was initially developed by the A. Gary Anderson Center for Economic Research at Chapman University and serves as an indicator of economic activity. Companies that employ temporary staff use the forecast as a guide to navigate through fluctuating economic conditions in managing their workforce to meet business demands.

About G. Palmer & Associates

Palmer & Associates, founded in 2006, provides advisory services in the human capital sector. Founder Greg Palmer has served on the board of the American Staffing Association and was president and chief executive officer of RemedyTemp, Inc., one of the nation’s largest temporary staffing companies, prior to its sale in June 2006. For more information, visit www.GPalmerandAssociates.com.