Are jobs and employment going sideways … or just returning to “normal”?

Several times last year during the pandemic — the last time was with the August 2020 employment report — we looked the different trends with those on temporary layoffs and those who permanently lost their jobs.

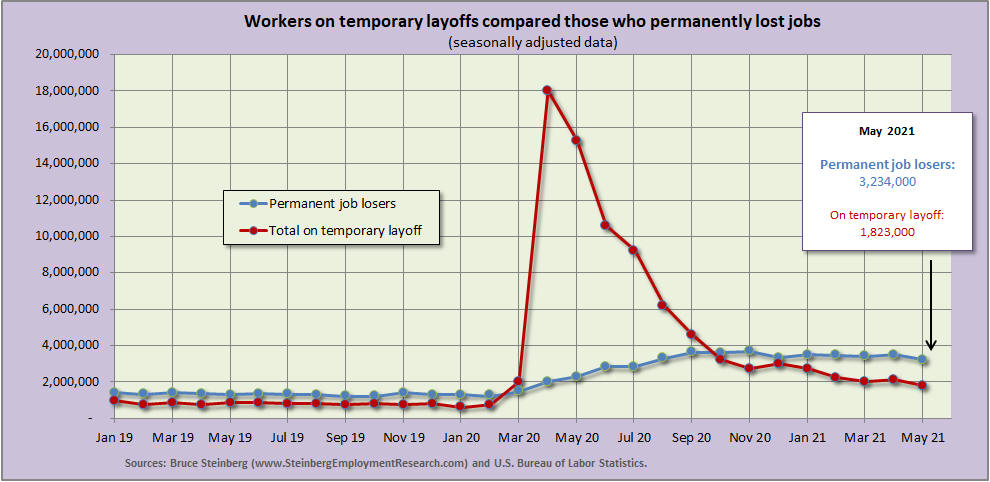

Regardless, those on temporary layoffs clearly skyrocketed at the onset of the pandemic and remained at a much higher level than pre-pandemic. Although the level has come down rapidly, it is still higher. The average number on temporary layoff per month from January 2019 to February 2020 was just under 805,000 before radically rising and then dropping; by May 2021, it was to a little more than 1,800,000, which is the first time it was under 2,000,000 since the pandemic.

For those who have permanently lost their jobs, the pre-pandemic level was just under 1,340,000 and gradually rose, albeit not as dramatically, during the pandemic and by May 2021 was a little more than 3,230,000.

Stated another way, there was an average of 1.7 people who permanently lost their job for each person on temporary layoff in 2019. By the height of pandemic-related job losses in April 2020, the situation was reversed and there were 890 people on temporary layoff for each person who permanently lost their job. Since that apex, the ratio been declining and somewhat returned to the pre-pandemic relationship (those who permanently lost jobs is greater than those on temporary layoff) and ratio has pretty much returned to the 2019 and earlier level. In March and April it was 1.7 but in May the ratio increased marginally to 1.8 people who permanently lost their job for each person on temporary layoff.

It is important to keep in mind that these data are self-reported so it is not really known if people were really on temporary layoff or it was just wishful thinking or employers were not being frank and dangled the prospect that furloughed workers will be the first to be rehired. In addition, the Paycheck Protection Program — a.k.a. PPP loans — that subsidized firms to keep laid-off personnel on their payrolls possibly encouraged some employers to report as “temporarily” laid-off employees that realistically had no chance of being rehired.

Initial unemployment claims still high but continue to improve …

The latest Beige Book also discussed that the rich unemployment benefits appear to be keeping workers from going back to work. A typical comment: “… generous unemployment benefits had made it difficult to bring payrolls back to desired levels, especially at the entry level.”

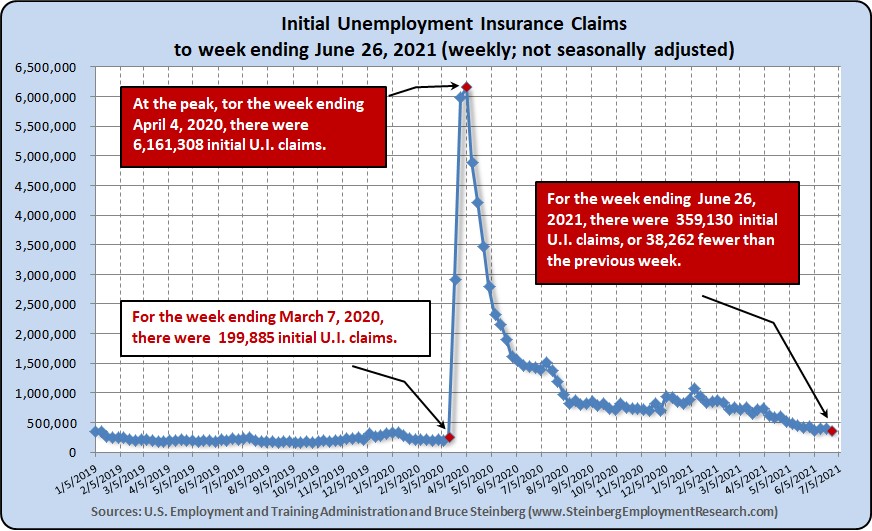

The number of initial unemployment claims continued to declined last week by slightly more than 3.5 times the decline of the previous week. BTW, the Labor Deportment changed the seasonally adjustment methodology because of the pandemic, which is why we report the not seasonally adjusted data for this series.

And now, a not rocket-science conclusion:

To state the obvious, these two charts look very similar. Fewer people on either temporary layoff or permanently lost their jobs tracks similar to the trends with the number of people filing initial unemployment insurance claims, but still at greater levels than before the pandemic.

June 2021 Employment Report

Quick recap

The unemployment rate drifted higher in June to 5.9 percent; a year ago as the full effect of the pandemic was hitting the employment economy, it was 11.1 percent. The unemployment rate increased because the number of employed persons declined — albeit marginally — and the number of unemployed persons rose. But here is some very interesting: overall job growth was relatively strong with a reported increase of 850,000, but that includes a 193,000 job boost at the state and local government levels. This inverse situation does not occur very often, but it’s not unprecedented. Read further in for the explanation.

Average hourly wages were up 10 cents in June after rising 23 cent in May. Again, the Bureau of Labor Statistics only slightly updated its statement from the previous month’s employment situation, “The data for recent months suggest that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages.”

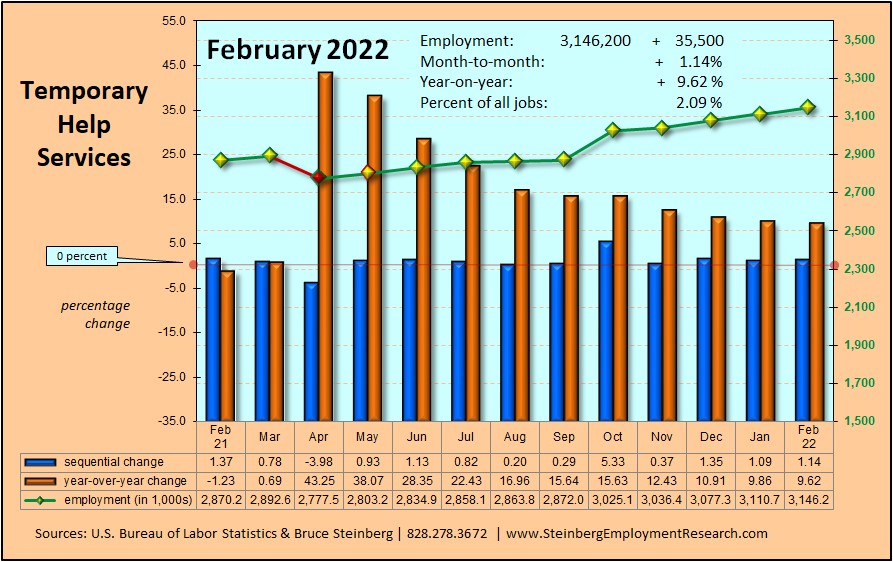

And Temporary Help Services reversed three consecutive months of declines — although quite minor in two of those three months — with a relatively solid gain in June.

Jobs Report

Private sector employers added 662,000 jobs in June, which was an improvement from the 516,000 added in May. A year ago, employers added 4,807,000 jobs in June 2020 after losing almost 20,000,000 in April 2020, the first full month that the pandemic affected the jobs data.

The private Goods-producing sector added 20,000 jobs in June after increasing by a similar 19,000 in May.

- Manufacturing continued to improve but slower with an increase of 15,000 in June compared to the 39,000 gain in May.

- The Construction sector continued to downsize with a decline of 7,000 in June that followed a 22,000 decrease in May as well as a 9,000 contraction in April.

- Mining and logging experienced an uncharacteristic large increase with a 12,000 job gain in June after adding 2,000 in May and 3,000 in April. Support activities for mining was the major driver for the June job growth with a gain of 9,700 jobs.

The volume continued to increase in private the Service-providing sector that added jobs to the tune of 642,000 in June after adding 497,000 jobs in May. A year ago the chorus increased by 4,302,000 jobs.

- The Retail trade sector rang up 67,100 more jobs in June after adding 26,700 in May. BTW, May initially reported a decline of 5,800 in the previous data release.

- The Wholesale trade sector continued to pick up the pace with an increase of 21,300 in June after adding 16,600 in May.

- Transportation and warehousing slowed with a gain of 10,700 in June after adding almost double that amount of 20,600 in May.

- Financial activities seemed to lose interest about hiring with a decline of 1,000 in June after removing 3,000 from its books in May.

- The Professional and business services sector doubled its hiring with 72,000 more jobs in June compared to the 36,000 it added in May. Computer systems design and related services was essentially flat with a marginal decrease of only 100 jobs in June after adding 2,500 in May that was initially reported last month as a decline of 600. Management and technical consulting services added 5,000 in June on top of the 3,500 it added in May. Architectural and engineering services were consistent with an increase of 2,800 in June that followed an increase of 2,200 in May.

- The entire private Education and health services sector added 59,000 jobs in June, with about a third of that growth in health care and social assistance. Home health care services took a step back with a decline of 3,300 in June after adding 4,900 in May.

- The Leisure and hospitality sector continued to spring into the summer season with the addition of 343,000 jobs in June after adding 306,000 in May and another 328,000 in April.

The total number of Government jobs was up 188,000 in June. The Federal government was down a total of 5,000 jobs and that included a 3,300 job reduction at the postal service. State government was up a total of 69,000 and Local government was up 124,000 both driven by increases in public education.

Temporary Help Services Roundup

Temporary Help Services finally experienced some solid growth with an increase of 33,000 in June that brings the total number of jobs to 2,666,300, which works out to a 1.3 percent sequential increase. May initially reported growth of 4,400 last month but was revised in the current data release to a decline of 6,500 jobs. Despite the ongoing recruiting problems and the skills mismatch, it remains encouraging to see that the sector is up 24.2 percent with 519,200 more jobs year-on-year.

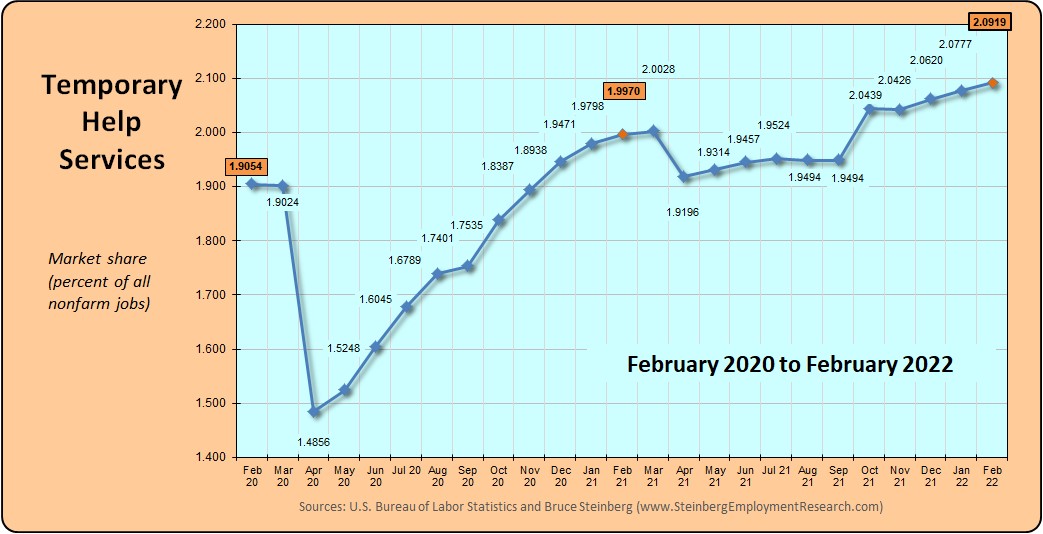

In June 2021, temporary help services market share, which is its portion of all jobs, was 1.8293 percent up from 1.8172 the previous month. A year ago in June 2020 it was 1.5577 percent and two years ago in June 2019 it was 1.9542 percent.

Household Survey

The unemployment rate marginally increased to 5.9 percent mainly because more people were considered as unemployed than the number the labor force increased.

The labor force expanded by 151,000 but there were 18,000 fewer employed persons and 168,000 more unemployed persons. The workforce participation rate was unchanged at 61.6 percent while the employment-population ratio was also unchanged at 58.0. Those considered as not in the labor force declined by 22,000. In June, many people returned to the workforce but since not all of them could secure a job immediately, the unemployment rate bumped up. The question remains as the rich unemployment benefits expire, how quickly will those returning to the labor force will be able to find jobs.

It does seem like a contradiction with a fairly strong increase in the number of jobs that the unemployment rate and its underlying components were so weak. But these data come from completely different sources and surveys that measure much different aspects of the jobs and employment economy.

BTW, we maintain an updated table of many major employment as well as other general economic indicators here or here for the mobile version.