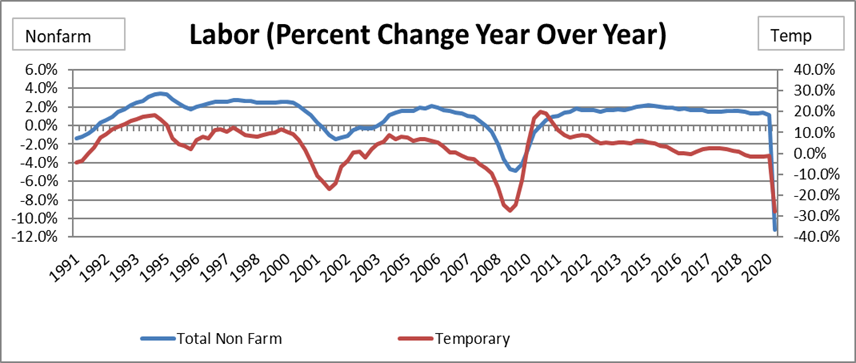

Labor Forecast Predicts 28.7% Decrease in Demand for Temporary Workers for 2020 Second Quarter; Covid-19 Pandemic Triggers Devastating Blow to Labor Market

— Industry Consulting Firm G. Palmer & Associates’ Quarterly Forecast Assists in Previewing Near-Term Hiring Patterns —

Reported provided by G. Palmer & Associates

Newport Beach, California, April 8, 2020— Demand for temporary workers in the United States is expected to decrease 28.7% on a seasonally adjusted basis for the 2020 second quarter, when compared with the same period in 2019, due to the Covid-19 outbreak, according to the Palmer Forecast™, released today.

According to the Bureau of Labor Statistics (BLS), results for temporary help for the preceding 2020 first quarter decreased by 1.1%. There were 49,500 temporary jobs lost in March.

“The 2020 first quarter marked the second consecutive year-over-year decrease in demand for temporary workers in the past decade, but the reported first quarter decrease just marks part of the story, since the data provided by BLS is only through March 12,” said Greg Palmer, founder and managing director of G. Palmer & Associates, an Orange County, California-based human capital advisory firm that specializes in workforce solutions. “Since the Covid-19 outbreak in the United States, we have seen an unprecedented 9.9 million initial unemployment claims filed in just the last two weeks of March, with expected GDP declines. It is now estimated that the 2020 second quarter will find the unemployment rate jumping above 10% and the GDP dropping by 10%. If this scenario occurs, the second quarter forecast we are putting forth will be substantially lower than the current forecast of a 28.7% decline.

“Without a doubt, labor numbers for April will be significantly worse than those of March. Putting this into perspective, the latest unemployment numbers for the week ended March 28, 2020 were ten times worse than the worst week during the Great Recession in terms of initial jobless claims, when 15 million jobs were lost over the 18-month period between 2008 to 2010. Many economists are excepting the job loss numbers to exceed those of the Great Recession in the next 90 days,” Palmer said.

For reporting consistency and accuracy purposes, the following statistic will reflect data provided by the BLS through March 12, 2020.

Source: G. Palmer & Associates; Bureau of Labor Statistics (BLS)

Source: Bureau of Labor Statistics (BLS)

According to the BLS, 29,000 temp jobs were lost for the 2020 first quarter. The BLS reported that, 42,000 temp help jobs were lost in 2019, an average of 3,500 fewer jobs per month. In 2018, more than 99,000 temp help jobs were added, an average of 8,200 per month. Additionally, 96,000 temp jobs were added in 2017, an average of 8,000 per month, versus 32,000 temp jobs added in 2016, an average of 2,600 per month. In 2015, approximately 97,000 temporary jobs were added, compared with 162,000 new temp jobs in 2014, 139,000 in 2013, and 142,000 in 2012.

The Labor Department reported a decrease of 701,000 seasonally adjusted non-farm jobs in March, which was far below consensus expectations of 10,000 jobs lost. In addition, January and February job numbers were revised down by 59,000 and 2,000, respectively. There were 176,000 jobs added on average per month in 2019 and 2.1 million total for the year, less than the 220,000 added per month in 2018, and 2.6 million total for the year. For 2017, a total of 2.1 million new jobs were created, versus 2.2 million new jobs in 2016.

The key job categories of jobs reduction are as follows:

• Non-farm jobs: -701,000 • Government sector: +12,000

• Hospitality and leisure: -459,000

• Education and Health Services: -76,000

• Service providing employment: -659,000

• Professional and business services: -52,000

• Construction: -29,000 • Goods Producing: -54,000

• Temp help Services: -49,500

Source: Bureau of Labor Statistics (BLS)

In March 2020, the participation rate dropped 70 bps from February to 62.4%. The U3 unemployment rate, generally reported as the official unemployment jumped 90 bps from February to 4.4%. The expected U3 is expected to reach 10% in the very near future. As reported by the BLS, the rate of unemployment for workers with college degrees ticked up 60 bps in March from February, to 2.5%, and the unemployment rate for workers with less than a high school education increased 110 bps to 6.8%. The U6 unemployment rate, which tracks those who are unemployed, as well as those who are underemployed and are working part-time for economic reasons, was up 170 bps from February, to 8.7% in March. The U6 rate is considered the rate that most broadly depicts those most affected by the last economic downturn and measures the rate of discouraged workers.

“One of the most revealing indicators to watch is the temp help penetration rate, because it measures temp help as a percentage of total employment. In March 2020, the temp penetration rate declined 20 bps to 1.91% of the total labor market, versus a low of 1.3% in June 2009,” Palmer said.

Source: Bureau of Labor Statistics (BLS)

The next few quarters

“The temp help employment market is expected to be down significantly over the next couple of quarters, until the GDP begins to rebound,” Palmer added. “With the single largest increase in unemployment claims filed in the last two weeks of March, since tracking began, the next few quarters will likely be the most volatile in recent memory.”

About the Palmer Forecast™

The Palmer Forecast™ is based, in part, on BLS and other key indicators. The model was initially developed by the A. Gary Anderson Center for Economic Research at Chapman University and serves as an indicator of economic activity. Companies that employ temporary staff use the forecast as a guide to navigate through fluctuating economic conditions in managing their workforce to meet business demands.

About G. Palmer & Associates

G. Palmer & Associates, founded in 2006, provides advisory services in the human capital sector. Founder Greg Palmer has served on the board of the American Staffing Association and was president and chief executive officer of RemedyTemp, Inc., one of the nation’s largest temporary staffing companies, prior to its sale in June 2006. For more information, visit www.GPalmerandAssociates.com. # # #